Planet

The EU petrochemical sector has made important strides in reducing both its emissions and its use of energy owing to improvements in manufacturing processes and enhanced product performance.

The petrochemical industry is focusing on creating products with enhanced performance, which in turn reduce energy consumption during their lifetime. Such examples include insulation in construction, lightweight plastics, solar panels, wind mills and water purification systems. The sector has also made significant progress in managing water resources more efficiently, reducing its use and preventing water pollution.

Reducing CO2 Emissions

Over the last 30 years, the petrochemical industry has set out to mitigate the effects of climate change and minimise its environmental footprint.

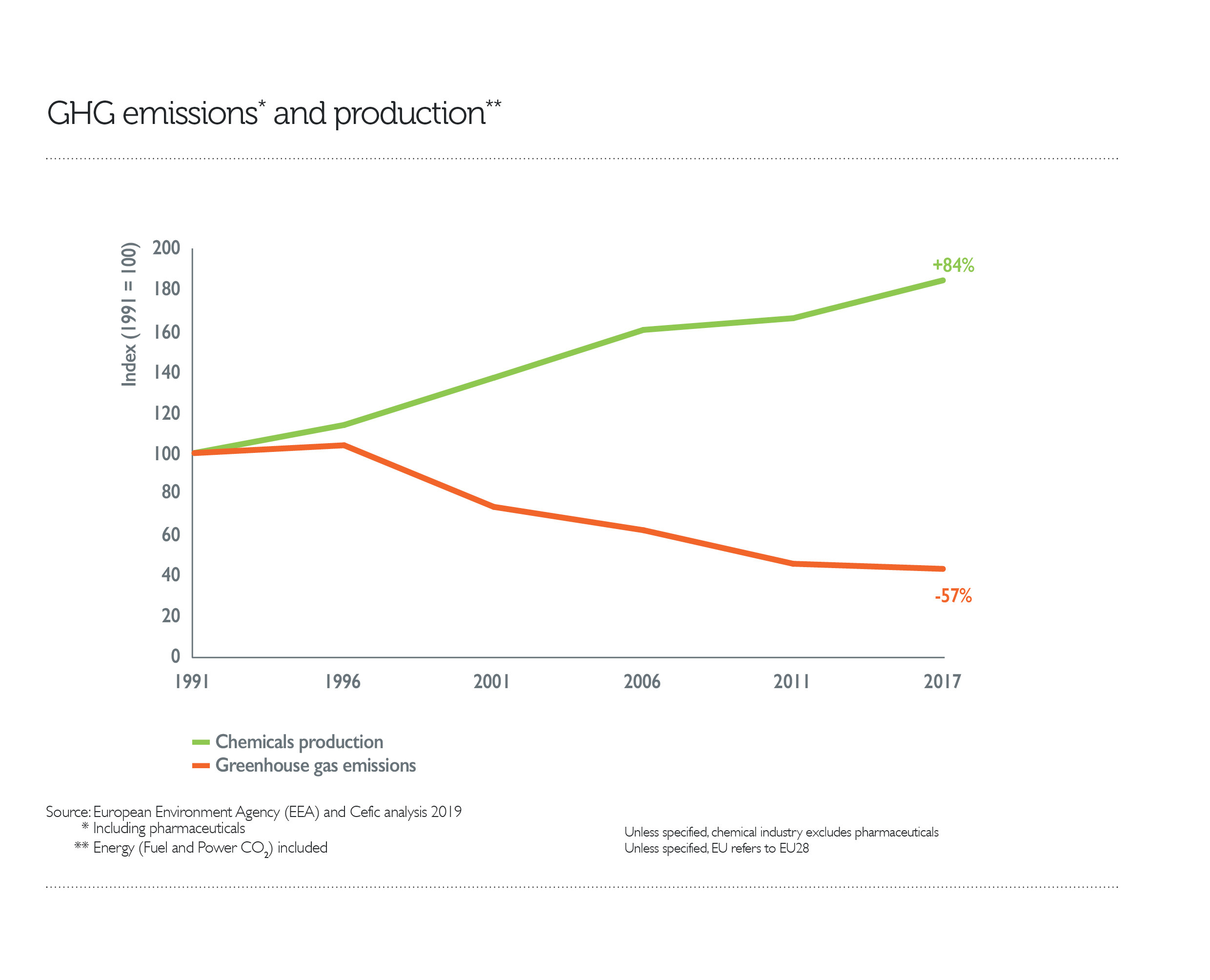

It has made notable progress and continues to strive to reduce it further. The European chemical industry as a whole has made dramatic reductions of its CO2 emissions, effectively more than halving them between 1990 and 2017 (-60%) while increasing its production by 84%.

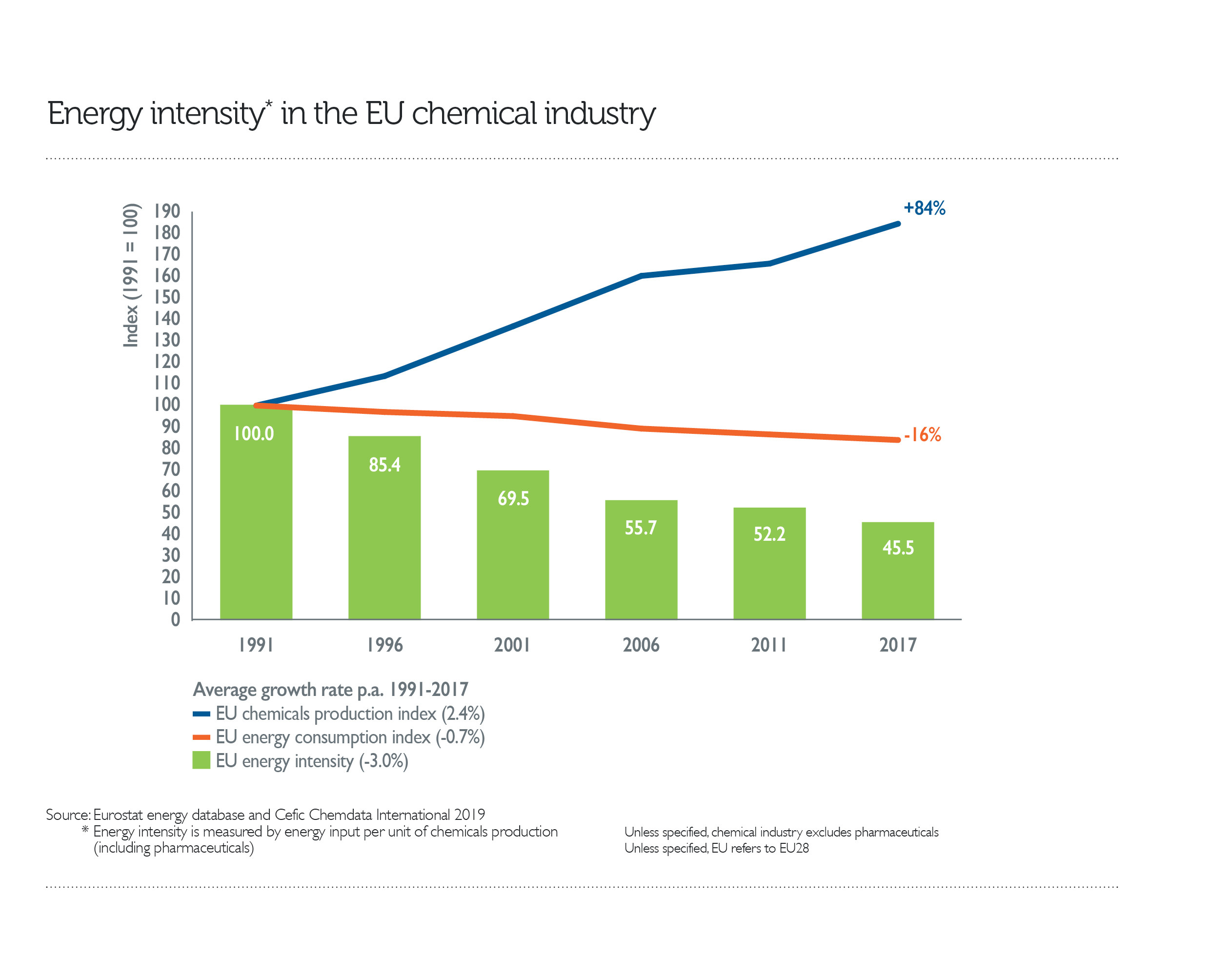

Key to the sector’s environmental strategy is reducing its energy requirements, in particular the energy intensity levels.

By 2017, energy intensity -energy consumption per unit of production- in the chemical industry, including pharmaceuticals, was nearly 55% lower than in 1991.

Research & Innovation

Our member companies have already taken initiatives to reduce their own carbon footprint while fostering innovation in low-carbon technologies.

These initiatives range from the electrification of steam crackers (facilities in which fossil fuels are turned into chemicals) to Carbon Capture and Storage/ Utilisation (CCS/CCU) and circular economy projects.

Electrification of crackers

Dow and Shell

In June 2020, Dow and Shell today announced a joint development agreement to accelerate technology to electrify ethylene steam crackers. Today’s steam crackers rely on fossil fuel combustion to heat their furnaces, making them CO2 intensive. As the energy grid becomes increasingly renewables led, using renewable electricity to heat steam cracker furnaces could become one of the routes to decarbonize the chemicals industry. The challenge is to develop a technologically and economically feasible solution.

First e-cracker in the world

In March 2021, BASF, SABIC and Linde signed a joint agreement to develop and demonstrate solutions for electrically heated steam cracker furnaces. The partners have already jointly worked on concepts to use renewable electricity instead of the fossil fuel gas typically used for the heating process.

Plastics recycling

MMAtwo

The “MMAtwo” project, which aims at improving Polymethyl methacrylate (PMMA) recycling technology, was selected by the European Commission within the SPIRE-10 call to receive funds from Horizon 2020, the EU Research & Innovation programme (2017-2020). The project could unleash a significant recycling potential and turn the PMMA consumption model from a linear to a more circular one. PMMA is a very durable, solid and versatile plastic that can last up to 20 years and which is used in a number of applications from architecture and automotive to transportation. The project coordinated by the Dutch company, Heathland, was launched in October 2018 and the Metacrylates Sector Group sits in its advisory Board.

Pilot MoReTec molecular recycling facility

LyondellBasell started the plant in September 2020 with the aim to return consumer plastic waste to its molecular form for use as a feedstock for new plastic materials.

Hydrogen

Total and Engie green hydrogen site

Total and Engie have signed a cooperation agreement to design, develop, build and operate the Masshylia project, France’s largest renewable hydrogen production site at Châteauneuf-les-Martigues in the Provence-Alpes-Côte d’Azur South region. Located at the heart of Total’s La Mède biorefinery and powered by solar farms with a total capacity of more than 100 MW, the 40 MW electrolyser will produce 5 tonnes of green hydrogen per day to meet the needs of the biofuel production process at Total’s La Mède biorefinery, avoiding 15,000 tonnes of CO2 emissions per year.

The project intends to build a renewable hydrogen production facility of 1 GW by 2030 to link it to the Dutch-Flemish North Sea Port cluster through an envisaged regional cross-border pipeline. The electrolyser, which will produce the renewable hydrogen, can convert about 20 % of the current hydrogen consumption in the region to renewable hydrogen. The major industrial companies in the region ArcelorMittal, Yara, Dow Benelux, and Zeeland Refinery, support the development of the required regional infrastructure to enable sustainably-produced steel, ammonia, ethylene, and fuels in the future, helping the Netherlands and Belgium to accelerate their carbon reductions towards 2030 and beyond.

Carbon Capture and Storage/Utilisation (CCS/CCU)

Antwerp@C

The project entitled Antwerp@C aims to keep CO2 out of the atmosphere and so to make a significant contribution towards the climate objectives, thanks to applications for capturing and utilising or storing CO2, all within a relatively short time span and at reasonable costs. The project has the potential to reduce the CO2 emissions within the port (18.65 million tonnes greenhouse gas emissions in 2017) by half between now and 2030. A number of companies located at the Port of Antwerp including our members, BASF, Borealis, ExxonMobil, INEOS, and Total are part of it to investigate the technical and economic feasibility of building CO2 infrastructure to support future CCUS (Carbon Capture Utilisation & Storage) applications.

The hub intends to implement Carbon Capture and Utilisation (CCU) to build a more climate neutral economy in the North Sea Port, the transnational port area that includes Vlissingen (Nl), Terneuzen (Nl) and Ghent (Be). The region has several assets for CCU: significant industrial point emissions of CO and CO2, high voltage grid connection with off shore wind, the presence of the chemical industry that use significant amounts of C1 products, the availibility of land, storage and piping facilities, strong innovation partners and knowledge insitutes nearby.

A first project will be the North-C-methanol, which consists of a 63MW electrolyser and 45000 ton/y methanol plant. A gradual upscaling of the electrolysis and methanol production capacity is foreseen, together with the diversification in the CCU products.

The Steel2Chemicals project focuses on the development of a closed value chain in which CO from residual gases from steel production is used as raw material in the chemical industry.Our member company, DOW, together with ArcelorMittal, Tata Steel, Ghent University and TNO, ISPT is investing in research to use carbon monoxide from blast furnaces for the synthesis of naphtha. This ‘synthetic’ naphtha can (partly) replace the demand for fossil naphtha used to produce e.g. ethylene, a major chemical building block and starting materials for plastics.

Circular economy

Circular Steam project

In September 2018, LyondellBasell (NYSE: LYB) and its joint venture partner Covestro kicked-off a large investment project at their site in Maasvlakte-Rotterdam, the Netherlands. The Circular Steam Project incorporates an innovative technology into the existing production plant to convert its water-based waste into energy. The new installation will take the site’s existing production process to a higher level of efficiency and sustainability, resulting in an overall annual reduction of ca. 140,000 metric tons CO2 emissions, 0.9 Petajoule of energy and avoiding the release of 11 million kilograms of salt residue into the surface water.

Petrochemicals companies have also signed partnerships with plastics recyclers:

- Quality Circular Polymers (QCP) Joint venture between LyondellBasell and Suez

- BASF’s partnerships with Quantafuel and New Energy

- SABIC with Plastic Energy: pilot use of recycled feedstock to produce polymers that will be certified as having been made with recycled materials

- Borealis, acquired the German plastics recycler MTM Plastics, a mechanical recycler of mixed post-consumer plastic waste and is one of Europe’s largest producers of post-consumer polyolefin recyclates.

- ‘Project Lodestar’ with 14 other companies in the value chain: mechanical recycling and feedstock recycling in an advanced Plastics Recycling Facility (aPRF)

- Neste partnership with Remondis to develop chemical recycling of plastic waste, collaboration with ReNew ELP, and investment in Recycling Technologies

- Total with Recycling Technologies and Nestlé and Mars to undertake a feasibility study to deploy a pyrolysis-based feedstock recycling plant in France.

Water management

Managing water more effectively requires a coordinated approach.

Water is vital and in a number of European regions, the balance between water availability and demand is becoming strained. Water is not only used for drinking and sanitation but is also an important component in industry. Water is required to produce energy and water uses large amounts of energy in its supply and transmission systems. With a move towards a bio-based economy, demand for water will only increase. Many of the current waste water treatment systems are unsustainable. The chemical industry is one of the largest users of fresh water and is subsequently also a leader in water treatment materials, technologies and conservation initiatives with its E4Water initiative.

The initiative aims to decouple economic growth from an increase in use of water. It develops, tests and validates new integrated approaches, methodologies and process technologies for water management within the chemical industry. It also investigates how these approaches could be applied across other sectors, for example, farming and manufacturing. Its impact is already significant since it has managed to reduce water usage by over 40%, waste water production by 20% and energy use up to 20%. Contributing to this initiative are large players in the chemical sector, EU water companies and research and development centres from a number of universities active in water management. The E4Water concept aims to continue to reduce water stress to aquatic ecosystems by decreasing the required uptake of fresh water combined with a reduction in pollutants released into the environment.

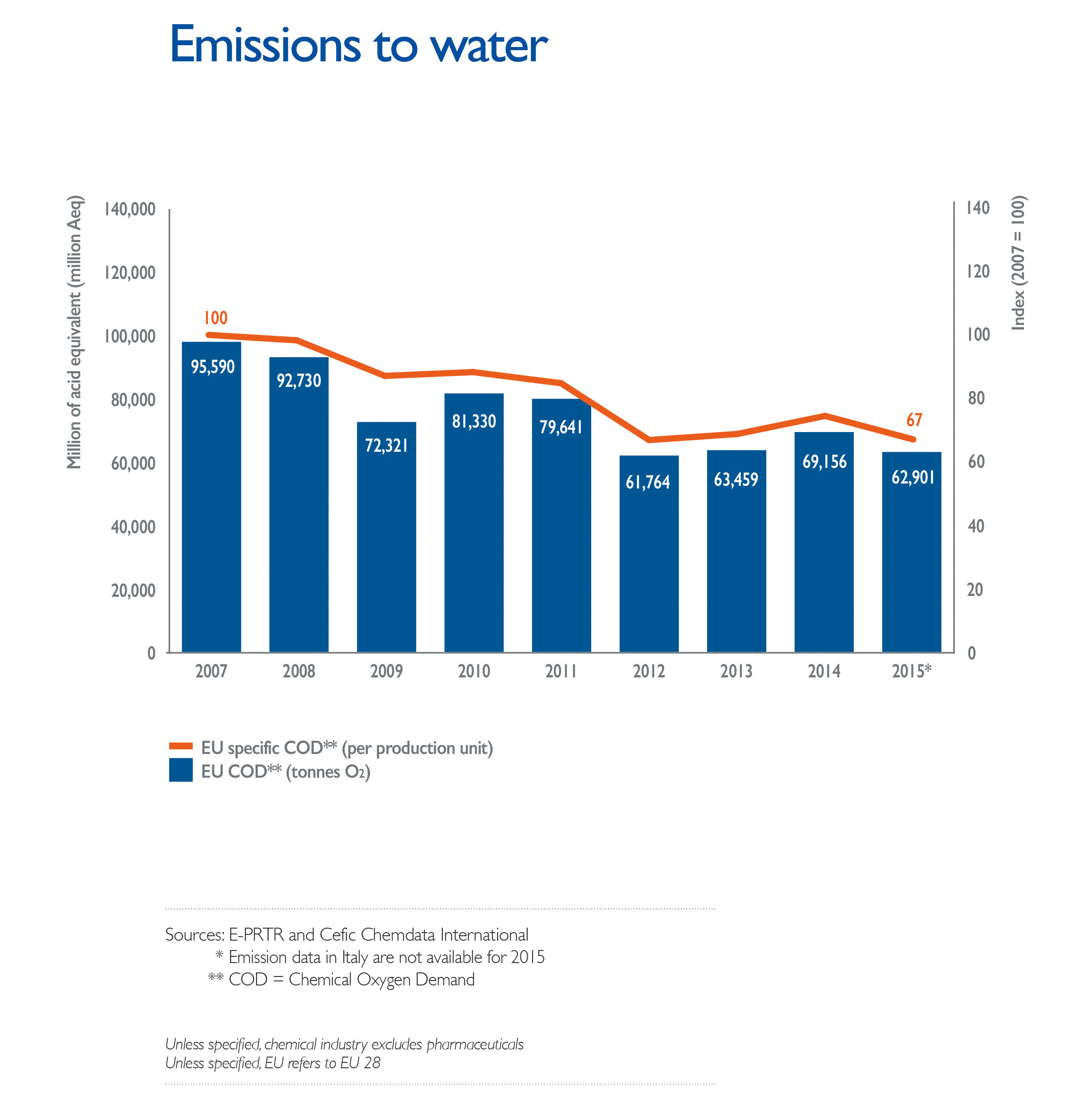

Chemical oxygen demand (COD) is used to represent the potential of chemical emissions to water to remove dissolved oxygen that would otherwise support aquatic life. The chart shows that between 2007 and 2014, the COD intensity of the EU chemical industry fell by 25.5%.

Energy Efficiency

Enhanced process efficiency drives energy savings.

In order to create products, there is a minimum energy expenditure requirement that will always exist, regardless of process efficiency. One of the ways that the sector is attempting to counterbalance even this reduced energy spend is by ensuring it extracts full value from the energy it uses. Essentially, the petrochemical sector is continuing to pursue one of its core strategies of “doing more with less” and one way is by operating closed-loop value chains which means that a by-product from one process becomes the raw material for another.

Closed-loop industry typically works in a number of ways, for example:

- The waste from a process is simply re-used and there is no need for processing or modification prior to its re-use.

- The material might need to be recycled or reprocessed, but once it has been modified, it can be used for the same purpose, for example, plastic bottles.

- Recovered material is modified and reused in an entirely different process.

- The closed-loop system has a number of benefits such as reducing the amount of ‘new’ raw material required and facilitating waste disposal by turning waste into a useable material.

Process efficiency not only makes good environmental sense, but also economic sense. For the EU petrochemical industry to be in a position to compete with other regions, it will need to continue to refine its production processes to ensure optimisation of efficiency in energy use. Regions outside Europe have an advantage as they benefit from lower feedstock and energy prices in turn making it easier for petrochemical producers to offer more competitive pricing for their products. The European petrochemical sector can only partially claw back savings through increased efficiency and is required to urgently continue its investment in innovating enhanced energy efficiency measures.

Enabling innovation in energy efficiency

Without continuous technological innovation, further energy savings will become increasingly difficult to attain. While petrochemical producers have made huge progress in energy reduction, they have almost reached a physical limit where any further reduction would not be of the same proportions as that already achieved. To continue the momentum of energy savings, the petrochemical sector is focusing on creating products with enhanced performance, which in turn reduce energy consumption during their lifetime. Such examples include insulation in construction; lightweight plastics used in cars and transportation, solar panels, wind mills and water purification systems.

Within the EU, heating causes approximately 14% of GHG emissions as up to 75% of the heat inside a building escapes through poorly insulated external walls. This is not only a challenge on a European scale, but is in fact a global issue as according to the International Energy Agency’s Energy Technology Perspectives 2017 report, heating and cooling in buildings and industry account for approximately 40% of final energy consumption — which is a larger share than transportation (27%). Stemming the loss of energy in the building sector remains a high priority.