EU chemical industry continues to grow

The EU chemicals sector continued to grow during the first quarter of 2018, but at a slower pace due to the Eurozone economy’s slowdown. Exports to the US rose by nearly 20% in value compared to last year. Petrochemicals accounted for 87% of the exports’ increase, although production decreased.

Chemicals production increased by 1.2% between January and April 2018, while chemicals prices surged 2.3%, compared to the same period in 2017. Petrochemicals production, however, decreased by 2.3% in the same period. Chemicals exports rose by 3.3% during the same period, whereas imports were up 1.7%, which resulted in an increase of €0.8 billion of the trade surplus.

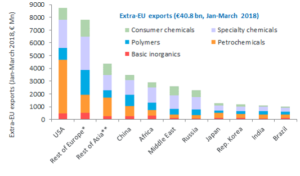

EU chemicals exports to the USA reached €8.8 billion during the first quarter of 2018, up from €7.4 billion last year. Almost half of these exports were attributable to petrochemicals. The US contributed 21.5% of total extra-EU chemicals exports, followed by Rest of Europe (excluding Russia, 19.2%). chemicals exports to Africa, Japan, South Korea, Middle East and China dropped.

Petrochemicals have to compete against Middle-East producers with advantaged oil and gas feedstock and shale gas-based petrochemicals from the US. Unlike specialty or fine chemicals, petrochemicals operate under classical commodity business conditions: customers buy exclusively on price. Oil and gas as feedstock and energy account for 80% of their production costs and European energy prices are amongst the highest in the world. Therefore, creating a harmonized and secure EU energy market at competitive prices is key to the industry’s competitiveness.

For further information, please read Cefic Chemicals Trend report, July.